How to invest in ETFs and Stocks from Taiwan

I’ve spent a tremendous amount of time investigating how to invest from Taiwan. Many expats asked me the questions, so I’ve decided to write down how I do it. I’ll also write different alternative options you could explore. This article will likely apply to Tax resident in Taiwan, non-US citizens and talk about long term investment (15+ years horizon).

Remember: I’m not a financial advisor, and invite you to do more research or seek professional advice. Again, US citizens and green card holders, please don’t follow the recommendations in my post, this post is directed to non-US persons.

Before starting: make sure to have an emergency fund

Do you have enough in your bank account for the next 6 months? This is one of the best recommendations. The main purpose of it is to act as a safety net if an emergency happens. This emergency fund will help give you enough buffer to cover any immediate needs, without touching your investment. No one is guaranteed to keep their job forever, accidents happen, a major repair of your home may be needed. Withdrawing your investment will hurt the returns on your investment, so this fund is key to preserve the performance of it.

I split my emergency fund between a foreign bank account and a taiwanese one:

- Taipei Fubon Bank: It has a decent English interface (and a new English app they’ve released in 2025). By experience, customer service at any branch in the city is pretty good. They’re also known for being the cheapest bank to send money abroad.

- Revolut: I am often abroad and the flexibility it gives you when you travel any country is great.

The downside of both is that you won’t get much interest on them. But the goal is to have access to cash at time you will expect the least, and it will help you and won’t hurt your investment. Your home country might give you some better interest rate accounts with saving accounts, but using your debit/credit card could involve some fees in the long term.

And why not only a Taiwanese bank? Because I’ve heard many stories of foreigners getting their bank locked for some really random reason (like your ARC expiring).

Which financial security to buy?

I’ll only focus here on a long-term investments for the next 15 to 30 years.

When buying a security for the long term, this is what you should consider:

- Diversification

- Low fees

- Understand the tax consequences of owning them in Taiwan

I personally recommend IWDA and EIMI ETFs. Let me explain.

Diversification with ETFs (and why I don’t recommend picking stocks)

On the long term, putting all your savings in a single company is risky (aka “put all your eggs in the same basket”). What if this company never grows, or worst goes bankrupt? Investing in multiple companies is a way to manage risks and minimize it.

There are financial products that help you diversify. They’re called ETFs. It’s like a group of shares of multiple companies grouped in a “single share”. By purchasing a single share of an ETF, it is like owning a part of a few to up to thousands of companies, across multiple countries.

* However, stock picking could be a good choice for you, if you understand the companies, their balance sheets, the market they are in. It is however time consuming, and most of the time people trying to do it end up losing money, trying to beat the market. This is why I won’t recommend it for inexperienced investors.

IWDA to cover developed countries

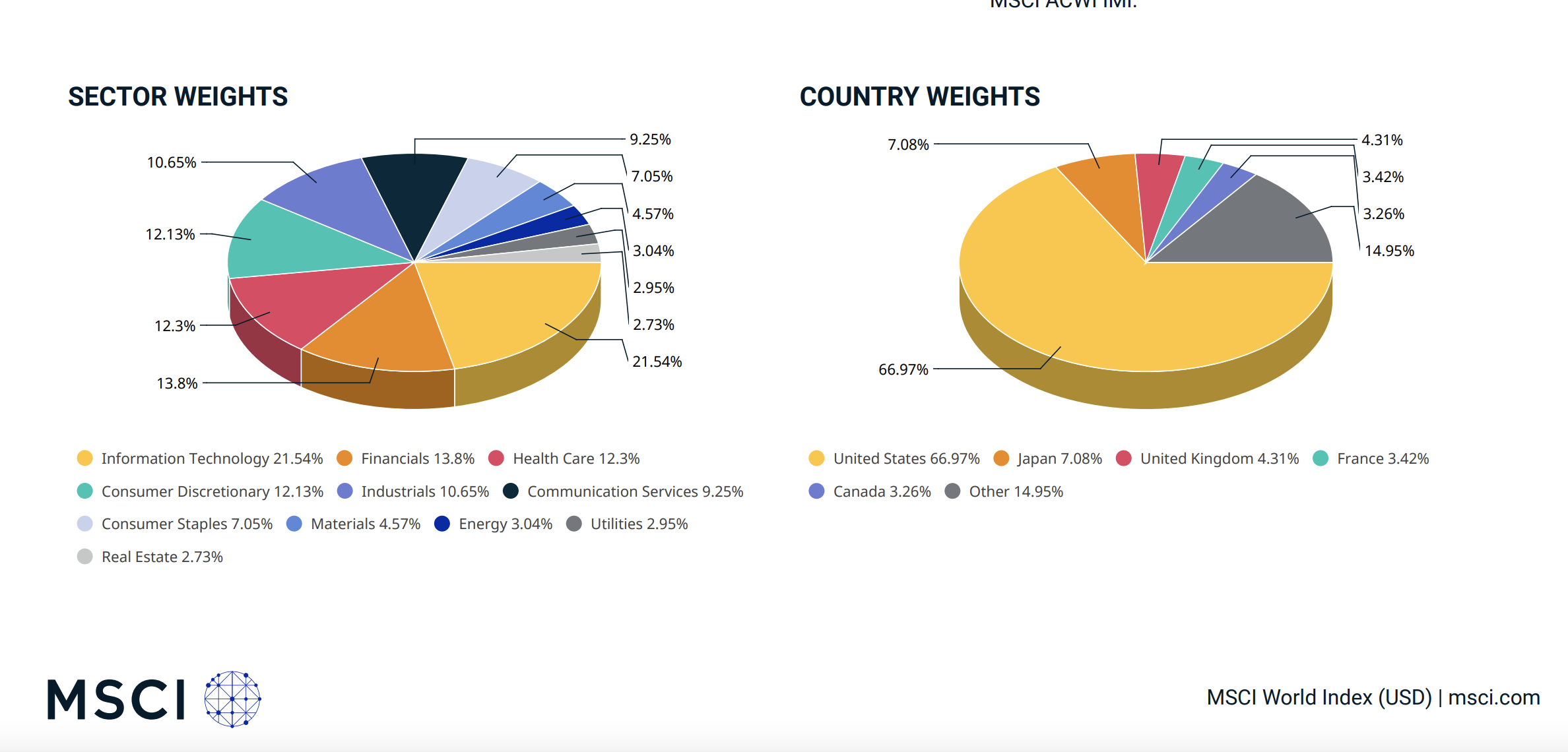

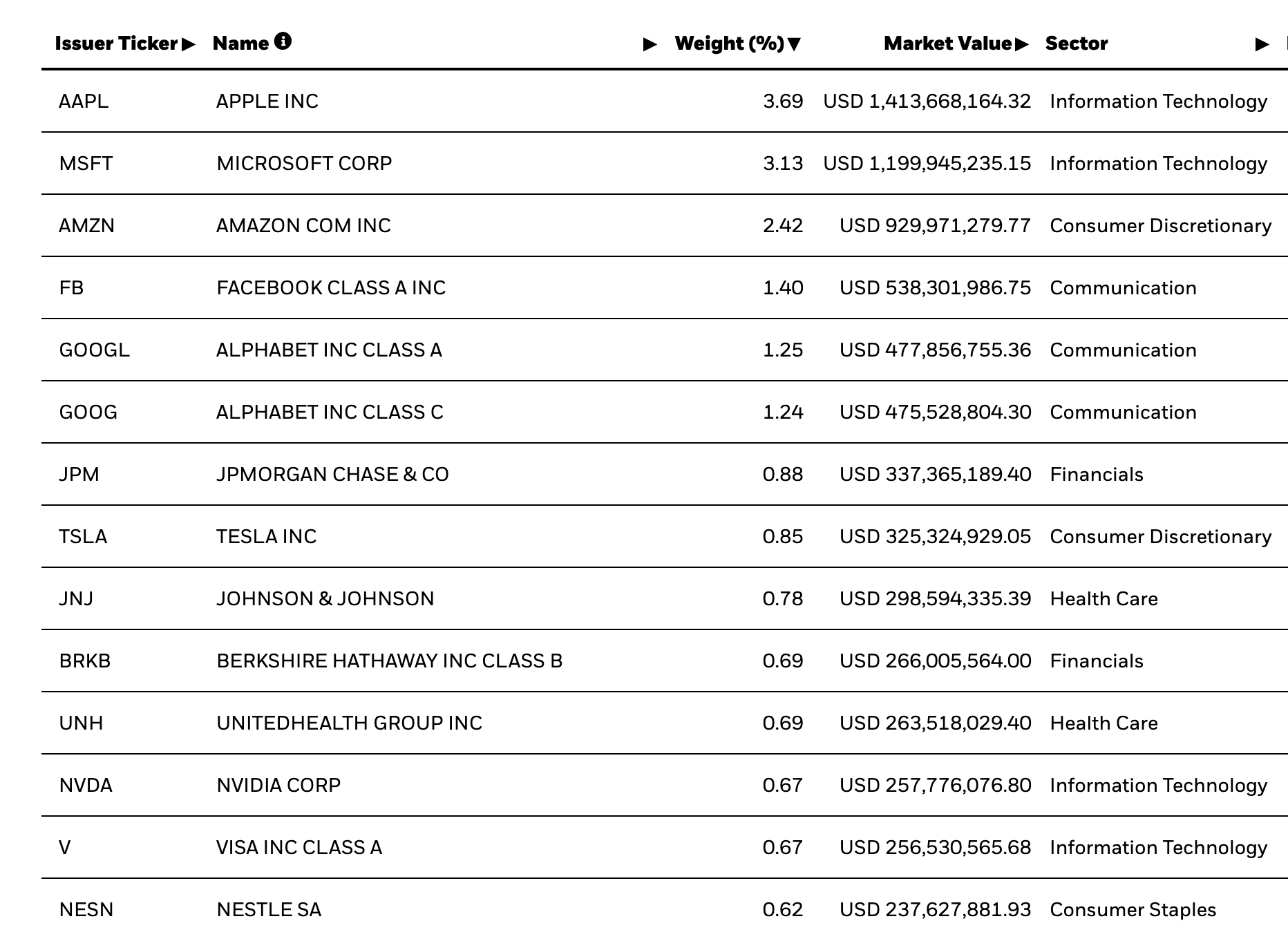

IWDA is one of the well diversified ETF I do recommend if you live in Taiwan. It is cheap to buy, is diversified, and the index it follows (MSCI World) has great performance (averaging 8.5% returns since 1987).

IWDA has exposure to all developed countries (US, France, Japan, UK, Canada, etc…) in the major industries (tech, healthcare, finance, consumers…). Buying 1 share of IWDA, is like buying indirectly a part of more than 1500 companies including Apple, Microsoft, Amazon, Tesla or Google.

Here are the top countries and companies it covers:

EIMI to cover Emerging Markets

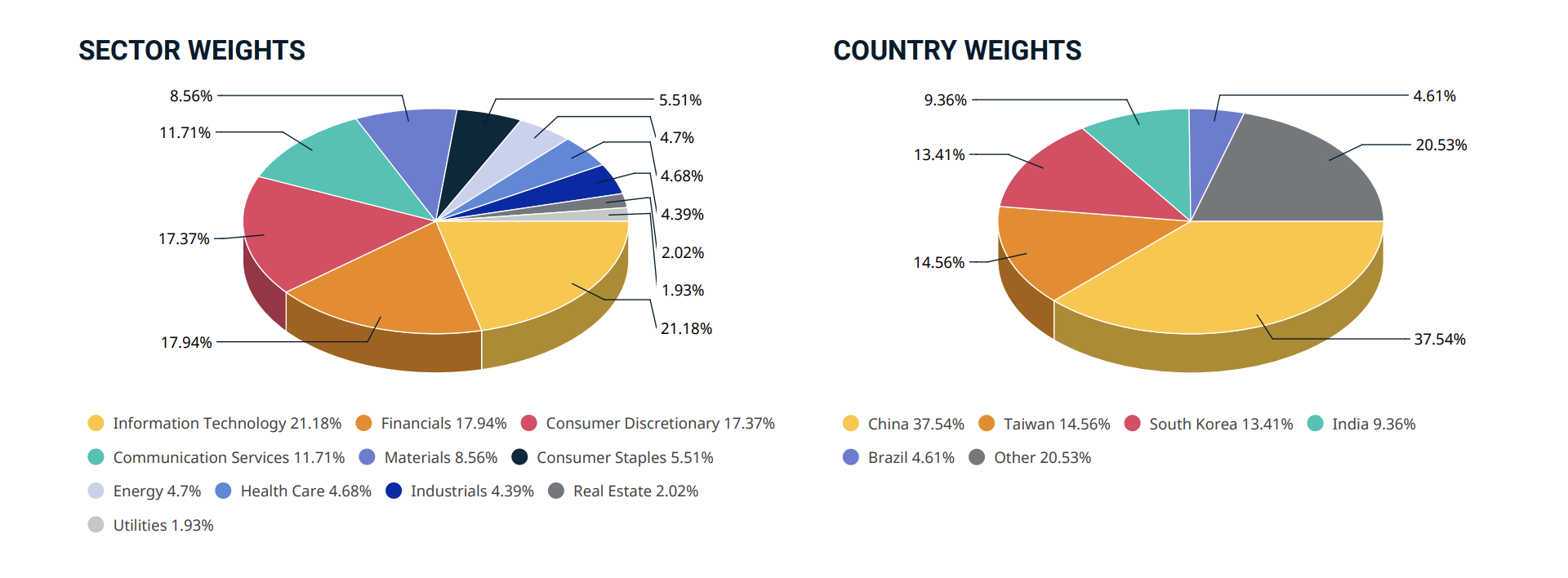

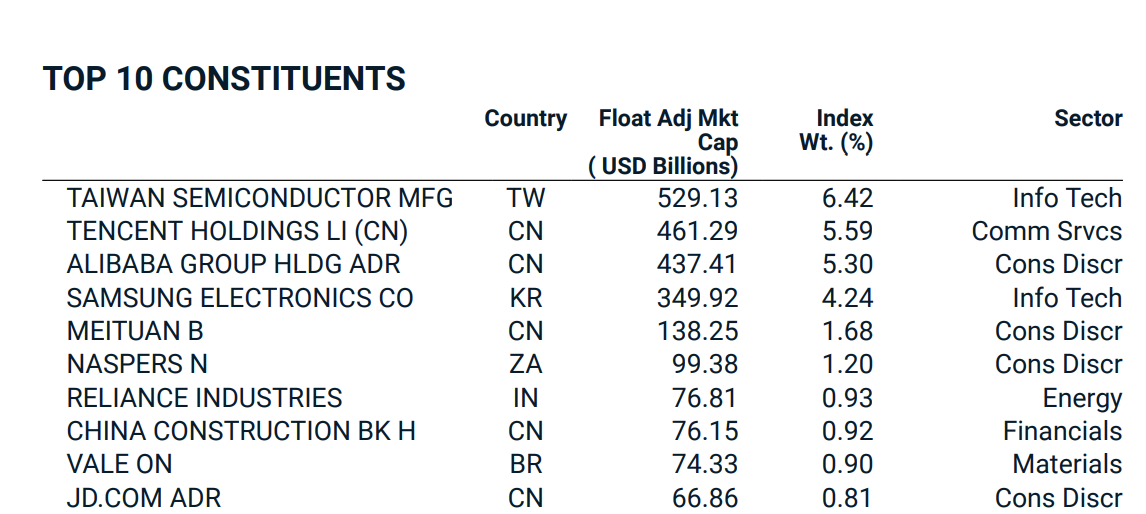

However, IWDA doesn’t have exposure to the countries in the “Emerging Markets” such as China, South Korea, India, or Taiwan. Having lived a few years in China and Taiwan, I have seen from my own eyes how vital the high-end Taiwanese companies are, or Chinese companies. I wanted to have exposure to those countries. EIMI is the perfect one for that.

EIMI is based on the MSCI Emerging Market Index. It covers 1300+ companies, within 27 countries, and has a return of 9.67% since 2010.

Why so many countries and companies? Isn’t IWDA enough? The reason is simple… how do you know which country or company will perform better than the other in the next decades? By investing in those 2 ETFs, you’ll basically bet into the world’s ability to grow. You will invest into the world’s biggest companies by purchasing a single share of it.

VWRA to cover both developed countries and emerging markets

Is there an Ireland based ETF covering both IWDA and EIMI? Yes. It’s VWRA. Buying VWRA is like buying IWDA and EIMI all together. It’s like buying a small share of 3500+ companies. It is also a good choice because you wouldn’t need to think about which one of IWDA or EIMI, so it makes the process of buying easier, without the need to calculate your allocation of IWDA/EIMI. The downside is that the expense ratio for VWRA (0.22%) is slightly higher than IWDA(0.20%) or EIMI(0.18%). VWRD is the distributing version of it if you want to manually reinvest the dividends.

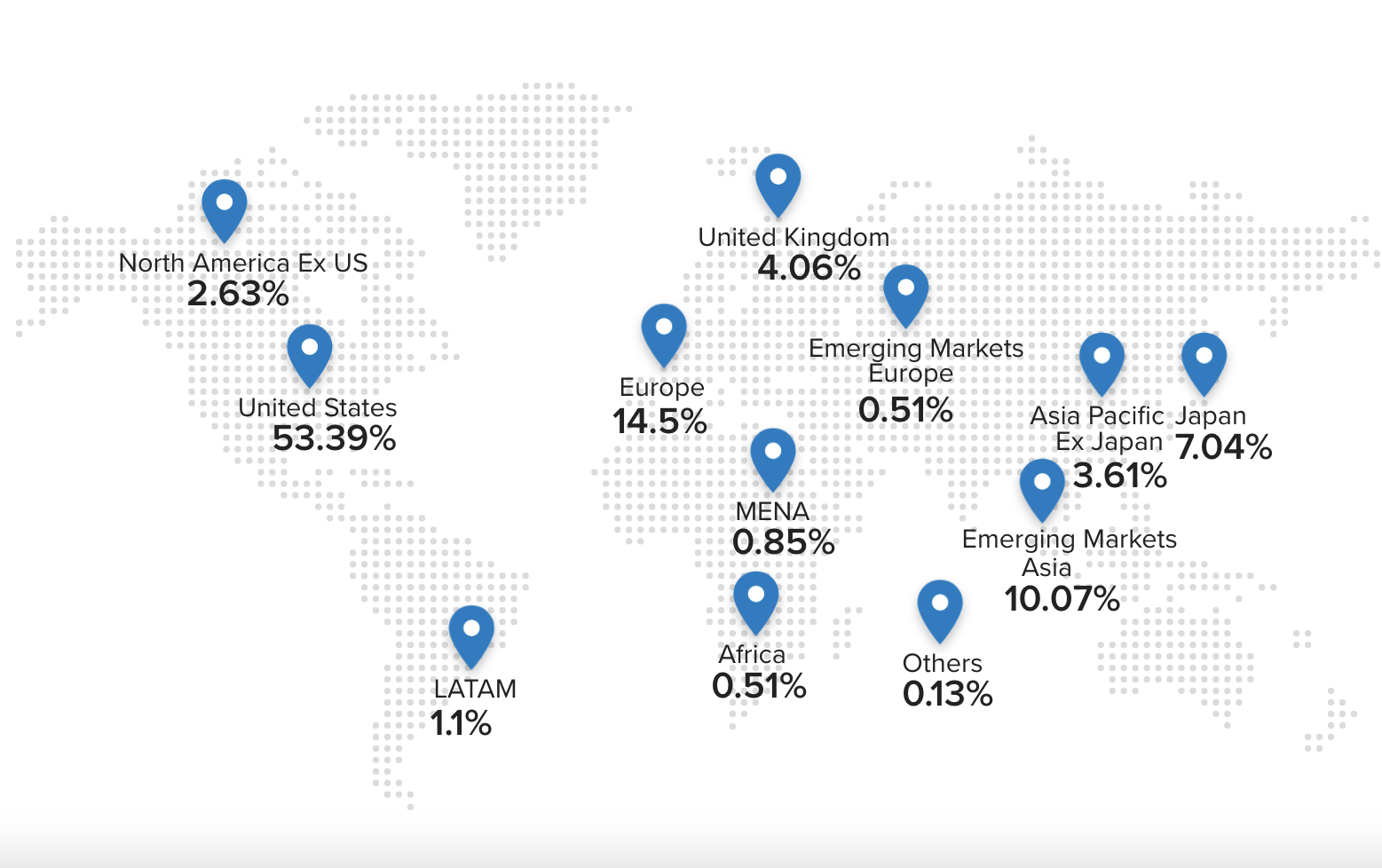

Here is how VWRA covers the entire world:

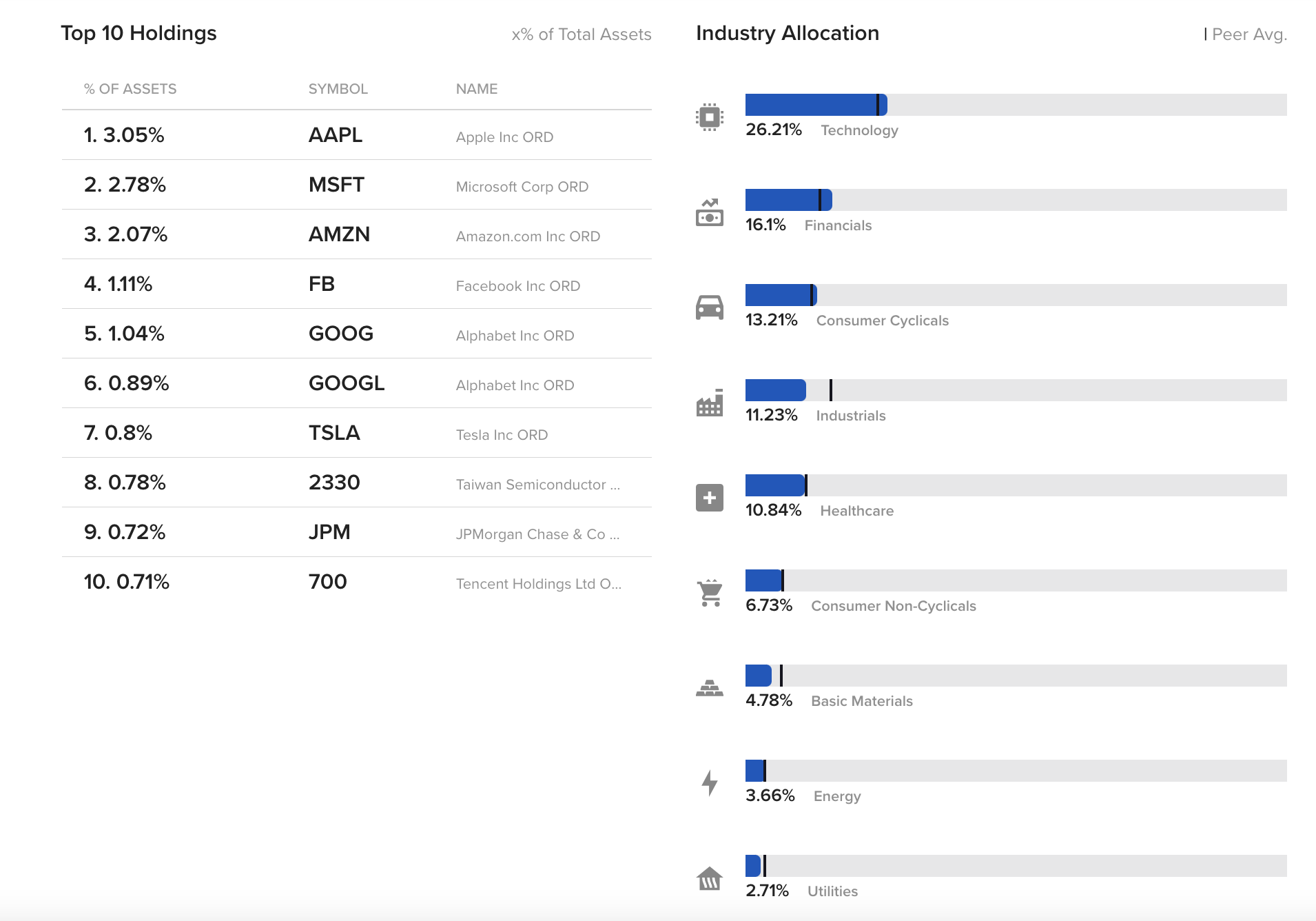

And how it covers all the industries, and the top holdings:

Low management fees

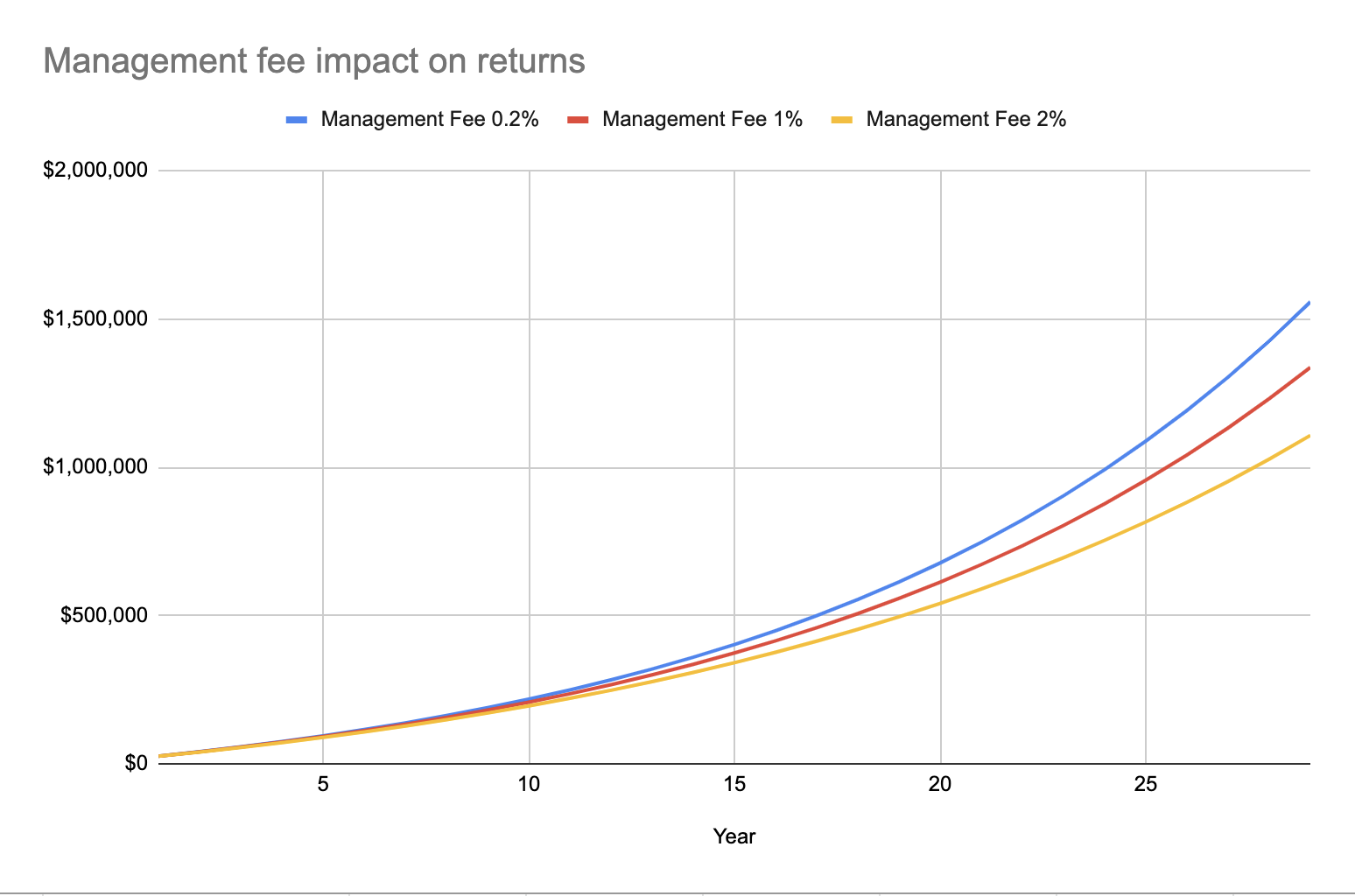

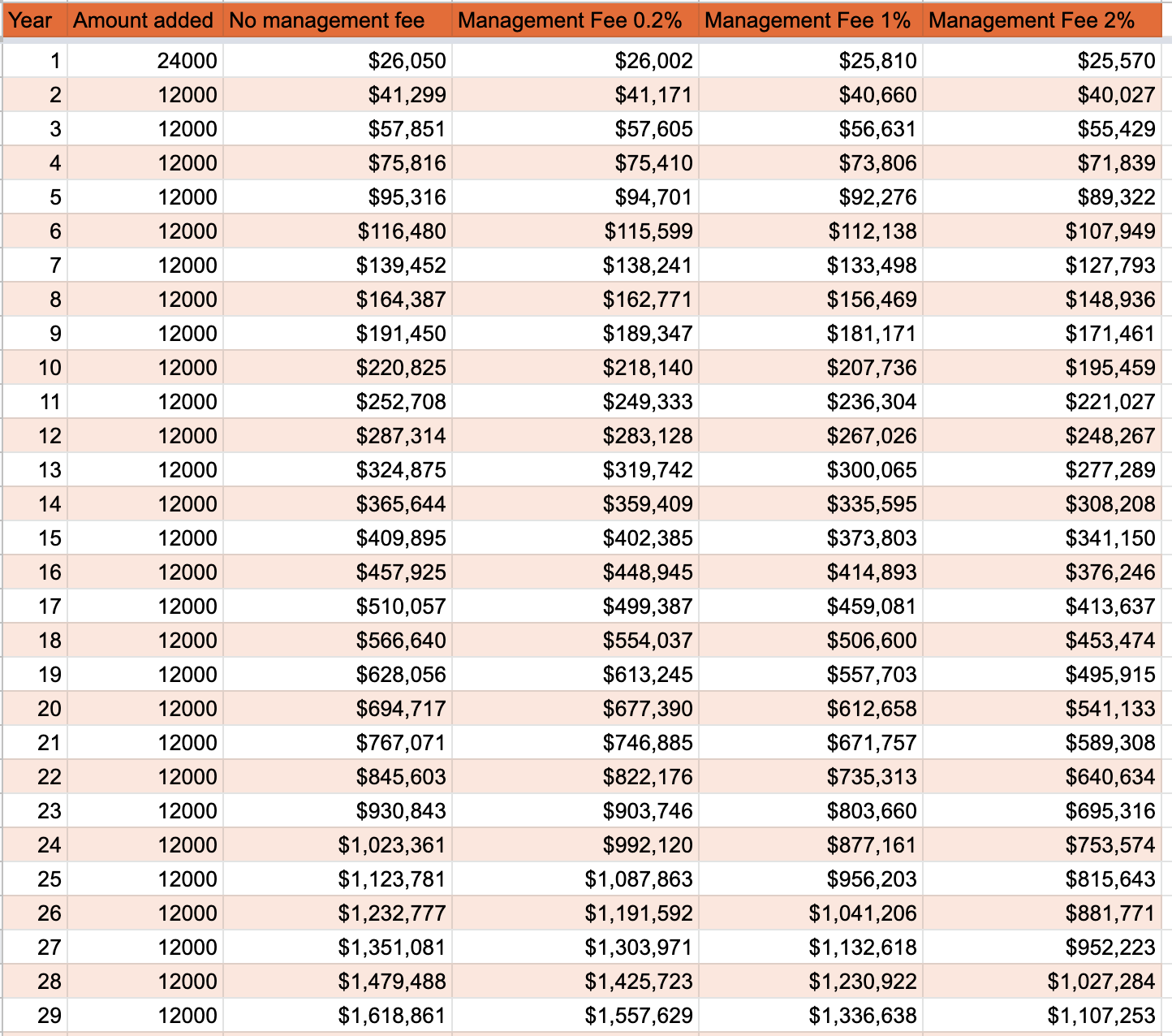

Too often, new investors don’t realize, or realize too late the importance of choosing low management fee ETF funds. Every funds charge fees. It can be anywhere from 0.015% to more than 2%. Even if 2% sounds not that much, it will negatively impact your final return. IWDA has a management fee of 0.20% and EIMI 0.18%, and are one of the lowest fees for an ETF. Here a visualization of your net worth with 3 different management fees:

With an initial capital of $12,000, and adding $1,000 every month over 25 years, with a 8.6% return (like IWDA):

- With 0,2% management fee, you’ll end up with $1,088,000

- With 1% management fee, you’ll end up with $956,000. It’s $132,000 less

- With 2% management fee, you’ll end up with $816,000, It’s $272,000 less

Some other scenarios are demonstrated on how fees impact the returns in Vanguard or the SEC websites.

Which broker should I chose?

Interactive Brokers (I’ll call it IB) is the one I highly recommend. You’ll access to all types of securities: ETFs, stocks and even currencies. It has the lowest fees to purchase them. It will also allow you to access the ETFs I’ve recommended earlier: IWDA and EIMI or VWRA/VWRD, among thousands of other ETFs and Stocks.

The signup process is straight-forward. Simply fill your information in the signup page, and wait a few days before validation. Make sure to fill your tax residence (Taiwan) since it could impact how the tax is taken directly by the broker (cf. below). Your Tax ID is the same as your ARC number. Also, be aware of the monthly fee if your orders don’t generate at least USD 10 of fees per month. The fee is waived if you have USD 100,000 of assets in your account.

How about local banks? Local banks will charge you quite a bit of fees to access to any foreign securities, but could probably be a good pick if you want to invest in Taiwanese securities. I won’t expand on this since I didn’t dig into this yet, but they generally charge an excessive amount per order, require a minimum stock per order, or charge an additional annual fee on top of of ETF expense ratio (They will charge a custodian fee because when buying securities via a bank in Taiwan, it is structured as a trust). Also, be aware: when your ARC expires, your bank (and investing) accounts will be frozen. You will have to move your assets out of your accounts, what will trigger some unwanted tax events (ask your CPA for the infamous exit tax). For all those reason, I think it’s good to stay away from for the long term if you are not sure to stay in Taiwan for the next 15 years.

Make sure to change to tier pricing instead of fix. By default, the fixed pricing is set in your Interactive Brokers account. It only makes sense if your orders are over USD 8,000 (~228k TWD). If below that amount, you to switch to the tier pricing. I’ve saved hundred of USD by doing this one-click change.

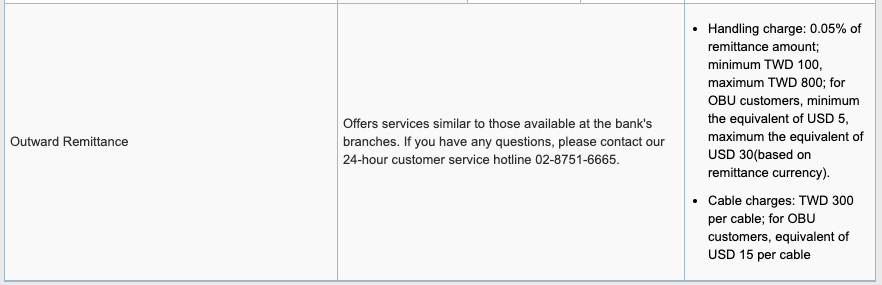

How to send money to Interactive Brokers from Taiwan? To be able to purchase financial products, you’ll need to fund your IB account with real money. IB will provide you information of a bank account located in the US (Citibank) to send your money. If your money is in Taiwan, simply go to your bank, and ask an employee to help you fill the document with the correct information. Taipei Fubon Bank has the lowest fees to send money abroad. It starts from 400TWD to 1100 TWD, depending of the amount you want to send. Here the detail of how Taipei Fubon charges on international wire transfer:

Protip: With Fubon, you can “link” the Interactive Brokers account to your account, so you could wire transfer online without coming to the bank again.

Can I send NTD/TWD to Interactive Brokers? No, you’ll need to convert first your NTD to USD, EUR, HKD, etc…, and then do the wire transfer. It should be doable from any Taiwanese banks. Here is a website listing the TWD/USD rates for every banks in Taiwan.

The rates difference are almost the same, and ranking can change considerably on an hourly basis. I wouldn’t choose a bank based on this information, unless you have a really big amount (more than 1,000,000 TWD) to exchange.

Is there a way to send money from Taiwan to Interactive Broker for free? There is no straightforward way to send money from Taiwan to Interactive Brokers, but here some tips:

- Taipei Fubon Bank is the cheapest way I’ve found to fund your Interactive Brokers account located in the US that is accessible to the most people in Taiwan.

- If you have an Europeean residence address, a hacky way would be to get your money in N26, and “withdraw” your money in Interactive brokers for free.

Tax in Taiwan

Tax on capital gain

The great benefit of Taiwan when investing is that there is no capital gain tax. It means if you buy a share for USD10 and sell it when it’s worth USD100, you won’t pay tax on the USD 90 profit.

Tax on dividends, and the importance of fund domicile

Taiwanese residents investing directly in the American market are taxed 30% on dividends. However, you can lower it to 15% by buying shares with a fund domiciled in Ireland.

What is important to understand when calculating tax on dividends is that there are multiple levels of taxation. I’ll give more details on how they apply at each level as a Taiwan tax resident:

- L1TW (Level 1): Percentage of tax withholding by a security’s home country on dividends distributed by that security to the fund . This will be applied at the broker level, and you won’t have anything to do. By default it is 30%, but if you buy shares via a country with a tax treaty, it can be lower. Ireland has a tax treaty with the US, so it can be lower to 15% if you use and Irish fund to get US shares.

- L2TW (Level 2): Percentage of tax withholding by the country where the fund is domiciled on the dividends distributed to the investor by the fund. Ireland doesn’t tax their non-resident. Since you reside in Taiwan, it will be 0%.

- L3T (Level 3): Percentage of taxation that the individual investor needs to pay in their home country. Since there is no tax on oversea income.

This is why I’ve picked IWDA / EIMI / VWRA. They are all located in Ireland. Since IWDA is composed of 60% of US companies, there is a bit of math to do to exactly know how much tax will be taken.

Calculating the tax on the dividends for a given ETF is a bit tricky. Since an ETF contains share of many companies from different countries, you’ll need to understand the composition of your ETF. Since there is a treaty between the US and Ireland, and most companies being in the ETF are located in the US, the tax on the dividends are in average ~12.1%.

How to fill your tax in Taiwan?

Simply show up at the tax office during the tax season and declare your gains. You can easily generate a statement in Interactive Brokers as proof. The tax office employees are really helpful. They speak English and will help you fill the forms.

Bottom Line

- Use Interactive Brokers to buy the ETFs (or stocks) at the lowest fees

- If your money is in Taiwan, Taipei Fubon Bank has the lowest fee to send money to Interactive Brokers.

- If you invest in ETF, prefers an ETF based in Ireland to optimize your returns.

- For taxes, go to the Taiwan Tax office with your annual reports, the tax officer will help you fill your taxes.

This post was originally published on November 29, 2020 and updated on February 2026

Next read:

🏦 DeFi: Make money like a Bank

🇹🇼 The world next innovations depend on a single country, Taiwan

🚲 Taiwan’s Bike sharing Infrastructure

Liked it?

As always, hit me up and let’s hang out. I'm now focused on CraftMyGame: build games in seconds, no code needed.

I also gather developers in Taiwan through TaipeiDev - come join us if you're in Taipei!